Reshoring Could Prevent Future Shortages Of Key Goods.

The U.S.-China trade war and the coronavirus pandemic have made a few things abundantly clear: Relying on foreign manufacturers is a risky, challenging, and, oftentimes, unwise business practice. Even before the COVID-19 outbreak, many economists and academics argued that America was excessively reliant on foreign manufacturers, particularly China, for too many vital products. Bob Forshay, a longtime supply chain consultant and supply chain management instructor who founded Boulder, Colorado-based Mastermind Group, LLC in August 2008, is one of those academics.

“We have a dynamic going on right now that’s a little bit unique because of what happened with COVID,” Forshay said. “I think that made everybody sit back and reevaluate what their supply chain strategies are and look at alternatives. For example, reshoring, which is the practice of transferring a business operation that was moved overseas back to the country from which it was originally relocated, is starting to get a lot more attention than it did. I’ve been talking about reshoring for 10 years, and it just hasn’t gained a lot of traction because the prices in China are so much lower. We don’t want to have all our eggs in one basket, and many companies are working hard to see what they can do to extricate themselves from China.”

Thus, as Forshay noted, to prevent future shortages of key goods, efforts to restructure manufacturing supply chains are underway.

President Joe Biden signs ‘Made in America’

Biden was sworn in as the 46th president of the U.S. on January 20. Roughly five weeks later, on February 24, he signed an executive order to review America’s supply chains. Manufacturers, especially automakers, from across the nation lauded Biden’s initiative.

“We welcome the Biden Administration’s continued support for supply chain resiliency, and we are committed to working collaboratively in support of U.S. manufacturing, jobs, and the environment,” John Bozzella, president of the Alliance for Automotive Innovation, a group representing major automakers selling vehicles in the U.S., told reporters.

Biden administration officials expounded on the executive order, called “Made in America.”

“We’re going to get out of the business of reacting to supply chain crises as they arise and get into the business of getting ahead of future supply chain problems,” the officials said. “This (order) is focused on ensuring that American supply chains are resilient, diverse, secure and promote broad-based growth across the country.”

Although Forshay hasn’t thoroughly evaluated Biden’s executive order to review America’s supply chains, he primarily views it as “a positive.” He also expressed concern about the nation’s lack of skilled manufacturing and tech workers and how that could adversely hamper the initiative.

“I know that these initiatives take time,” Forshay said. “I think anything in that direction is the right direction. I think we need to continually push. We’ve spent 25 years giving away our manufacturing expertise to other countries and giving our jobs away, and now here we are. Seemingly everywhere I’ve gone over the last six months, I’ve seen ‘help wanted’ signs. Manufacturing companies are having problems securing skilled manufacturers because we no longer have as many skilled manufacturers, and that’s a shame, and I think that’s where the U.S. has been short-sighted in so many different things. We set ourselves on a path that is very hard to come back from.”

Could reshoring entice young people to consider manufacturing careers?

At many high schools across America, guidance counselors push the notion that a college degree is the only path to success. Unfortunately, that notion is outdated and flat-out inaccurate. Careers in manufacturing don’t require a college degree, and the jobs are rewarding, reliable, and pay well. With reshoring initiatives and domestic supply chain woes receiving mainstream media attention, Forshay hopes that members of Generation Z will help fix the manufacturing labor shortage.

“We’ve had a narrative in the United States for a long time that if you don’t have a degree, you aren’t going to have the same opportunities that people with degrees have,” Forshay said. “There are still many companies that won’t even interview a person if they don’t have a college degree. I think that’s a narrow view, and I think that limits the possibilities. We need public school systems to get rid of that mindset and list all options to help raise awareness about manufacturing careers.”

Larry Caschette, the president of Denver-based Metalcraft Industries Inc., echoed Forshay’s sentiments.

“It seems to me that we’re truly at a tipping point,” Caschette said. “We still have some true, old-school craftsmen in the workforce who can pass their knowledge onto youngsters. But once they’re gone, it will take decades to get back up to speed. That’s why I would argue that we shouldn’t encourage all students to attend a four-year institution. Some students are simply better suited for trade schools, and we need to advocate that.”

What are the benefits of reshoring?

Reshoring can, among other advantages, strengthen the U.S. economy, balance trade and budget deficits, minimize regulatory compliance risks, significantly reduce delivery and distribution costs, lower unemployment rates, improve product quality, and create a more effective and resilient supply chain. Moreover, with fraying relations between the U.S. and China, an ever-increasing number of Americans want domestically-made goods that are generally regarded as higher quality. Forshay praised the quality of U.S.-made products and explained the potential perils of doing business with the Chinese Communist Party (CCP), an authoritarian regime that owns the vast majority of China’s companies.

“I think, in general, many Americans don’t realize that businesses in China are owned by the government,” Forshay said. “It’s the Chinese government that is driving the business activities there. Many people also don’t realize the price we pay for buying cheap, China-made products that are sold at Walmart or similar stores. A reason that many companies buy such cheap products is that CEOs sharpen performance objectives, tend to want profitability no matter what, and target 90-day results. Many business decisions are made with this small window period in mind. I believe that’s short-sighted thinking that often does more harm than good, but that’s the reality. I also think a lot of companies need to spend more time on risk management than they are right now, but at the end of the day, there’s a bottom line that comes down to cost.”

Forshay elaborated and mentioned that he’s observed some Colorado-based companies essentially ignore risk management and remain bound to China for financial purposes.

“I’ve seen smaller companies here in Colorado that start sourcing low-cost materials in China,” Forshay said. “They don’t even do a supplier visit. They don’t travel there. They don’t see the factory. They don’t meet the people. They just start buying from there. And that is just an open ticket for a problem.”

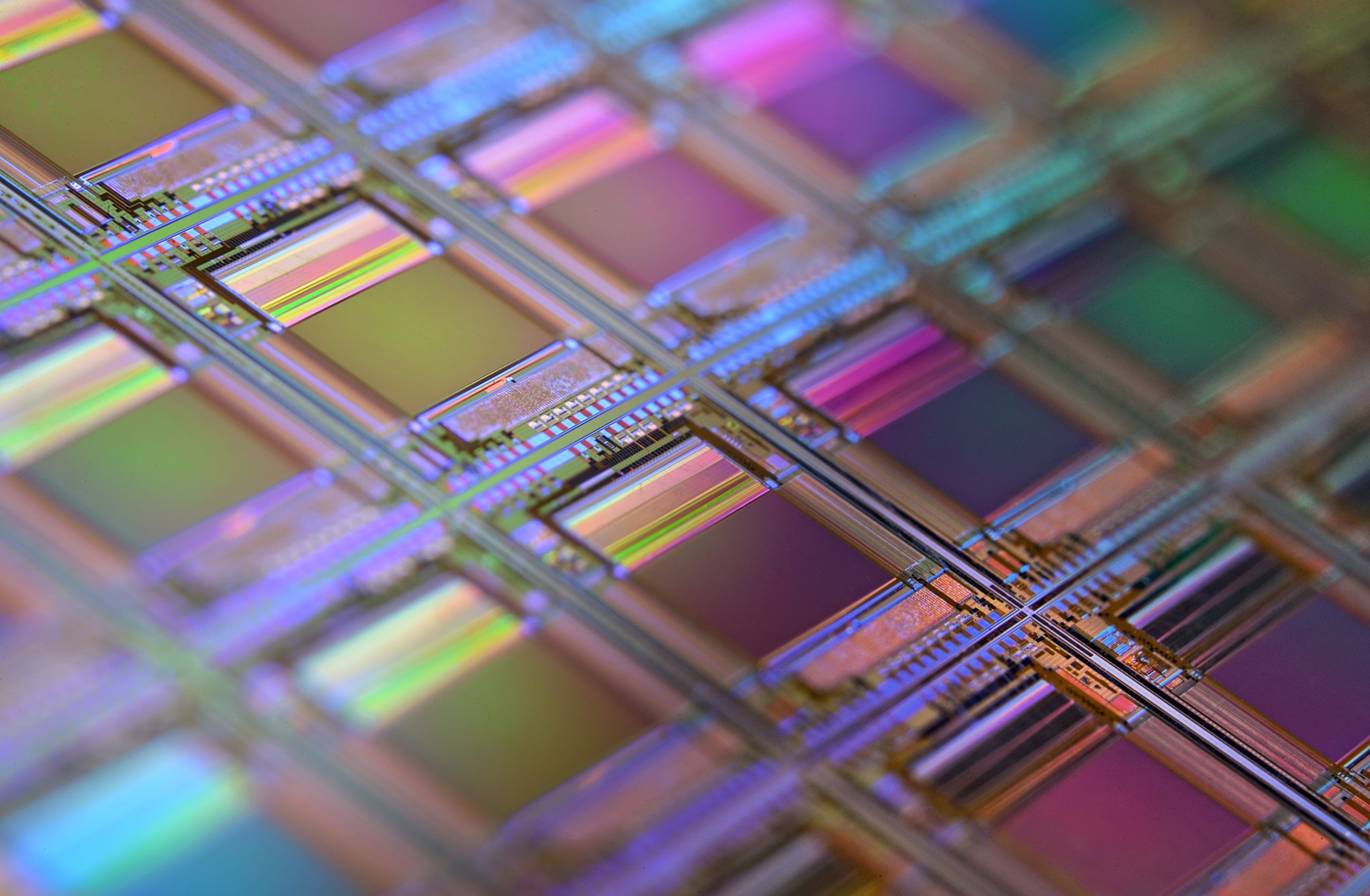

What caused the global chip shortage?

According to research firm Gartner, the global chip shortage that is severely impacting multiple sectors isn’t set to subside before well into 2022. The main reasons for the current chip shortage are due to tensions between the U.S. and China and the pandemic. Gartner says that Chinese tech companies have been amassing record amounts of chips and chip-making equipment. To transfer global supply chains away from China, Biden administration officials are also determined to deepen trade and diplomatic ties with tech-juggernaut Taiwan. A democratically ruled country, Taiwan is home to many chipmakers, including the world’s largest semiconductor foundry, Taiwan Semiconductor Manufacturing Co Ltd (TSMC).

The problem with depending on Taiwan for chips, and other products

Taiwan, which in May was ranked as the world’s 16th wealthiest country by Global Finance Magazine, has been governed independently of China since 1949. Nonetheless, the CCP considers the island to be a renegade province and part of its territory and has long vowed to “unify” the two countries. Beijing has recently enhanced political and military pressure on Taipei and many onlookers believe that an all-out attack is imminent. Consequently, although he praised the manufacturing abilities of Taiwan, Vietnam, Thailand, Japan, and the Philippines, Forshay reiterated the need to reshore, rather than seeking more foreign manufacturers.

“China recently sent like 30 fighter jets over Taiwan’s airspace, and they were running a few warships around the country for three days,” Forshay said. “It’s like, ‘Hello!’ That should be a wake-up call right there. When you’re reshoring, you have to consider the different elements. For instance, if you’re buying chips from Taiwan right now, you better be thinking about an alternative supply chain source if China goes after Taiwan in the next five years. It would be irresponsible not to be thinking about that.”

Supply chain contingency plans

COVID-19 is the first pandemic to emerge since the Spanish flu in 1918. Hence, it’s somewhat difficult to criticize companies that are suffering due to the global chip shortage. Nevertheless, Forshay is baffled that the auto industry didn’t have contingency plans in place for supply chain disruptions and strategies to proactively react to them.

“I am kind of surprised that the auto industry allowed themselves to get into this situation,” Forshay, who has worked as a supply chain architect for Mattawan, Michigan-headquartered MetaExperts since January 2009, said. “People have asked me, ‘So, how would you predict a COVID event?’ Well, you don’t predict a COVID event. You look at risk, and you look at what kind of things can have that size of an impact. When I was in the high-tech arena, we lived and died by lean supply chain, and we were very dynamic. We always had a plan B in place, and sometimes we were already discussing a plan C. Plan B is developed with better planning and using a more structured approach with S&OP (sales and operations planning) to more proactively address risks and gaps in the supply chain.”

How to develop a successful supply chain strategy

Personal protective equipment, pharmaceutical, and semiconductor manufacturers have faced exceptionally dire supply chain issues since COVID-19 surfaced. Per a survey conducted by Everstream, the pandemic hindered 98 percent of global supply chains and industries that heavily invested in outsourcing, offshoring, and lean manufacturing to minimize expenses saw dramatic upticks in risk. Accordingly, Heartland Forward’s February survey found that 70 percent of companies queried were “likely” or “extremely likely” to reshore their advanced manufacturing supply chains in the coming years to prevent similar problems from again arising in the future. But the question becomes: How can companies develop a successful supply chain plan?

SCMDOJO is a company that aims to help supply chain professionals and supply chain teams solve the problems they face in their jobs and businesses. They suggest that companies looking to establish a supply chain strategic plan start by defining their supply chain goals, key tactics, and initiatives to achieve goals and create a supply chain strategy outline. Essentially, the foundation of nearly every successful supply chain effort comes from a well-conceived plan.

Forshay agreed and added that any successful supply chain plan must focus on schedule adherence, which leads to continuity.

“Schedule adherence is absolutely critical to any supply chain effort,” Forshay said. “It’s about creating predictability and reliability. Continuity of raw material supply is a huge factor. If I know I have to put 12 into a process to get 10 out of the process, I don’t know which two are going to fail. But I do know that my schedule is going to take a hit. I just don’t know when. So, there’s a lot that feeds into schedule adherence. In many ways, adhering to an assigned schedule is the backbone of a solid supply chain plan.”

Metalcraft is a strong proponent of reshoring

Metalcraft, a metalworking firm that offers CNC machining services, precision sheet metal fabrication, metal stamping, contract manufacturing, and a vast array of post-production services all under one roof, strongly endorses reshoring efforts. As the movement continues to gain momentum, it’s fair to ask: Will the coronavirus pandemic that revealed the fragility of supply chains spawn a new era of prosperity for the American manufacturing sector? The answer to that question should be known within the next decade.